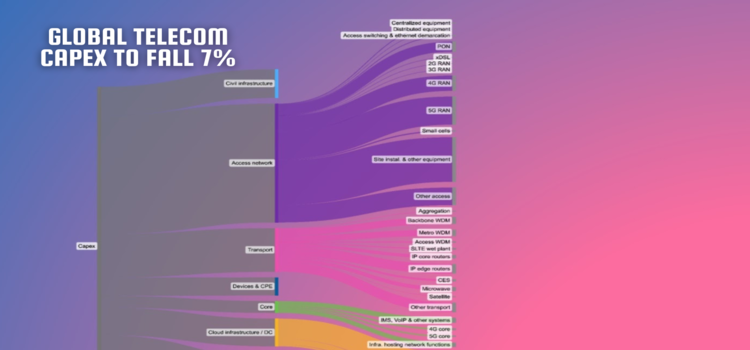

According to Dell'Oro Group, global telecom capex, which includes investments in both wireless and wireline carriers, is predicted to decrease by 7% between 2022 and 2025. Despite short-term increases in capital intensities, the overall trend has remained flat for over a decade.

The introduction of 4G and 5G technology has not altered the revenue trajectory, resulting in a projected decline of 2% CAGR in global telecom capex over the next three years. While India is expected to experience positive growth and Europe is expected to remain stable, North America will see a steeper decline in capex.

In the US, the transition to steady-state conditions will lead to a 25 to 30% reduction in wireless activity over the next three years. With no significant change in revenue trajectory expected, capital intensity ratios are on track to approach 16% by 2025, slightly below the current trendline.